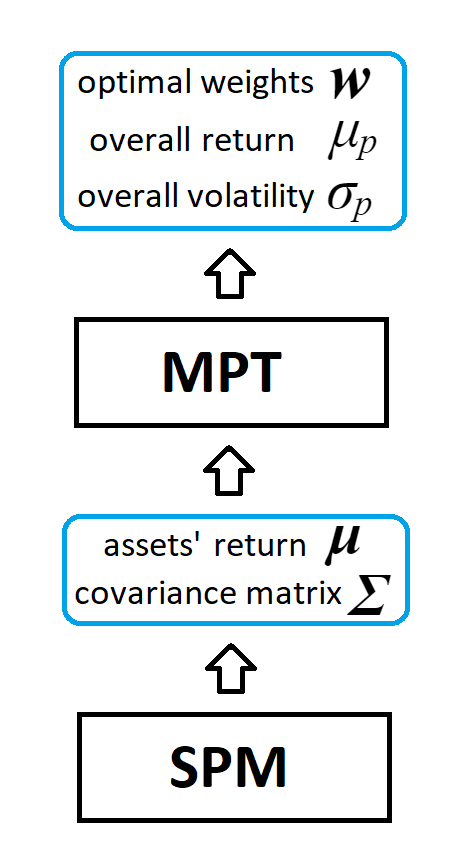

Complementing the Modern Portfolio Theory

The Origin

Key Definitions

| TERMS | DEFINITION |

|---|---|

| Expected Return | μₚ ≔wᵀμ |

| Standard Deviation | σₚ ≔ √(wᵀΣw) |

| Sharpe Ratio | Sₚ ≔ ( μₚ - 1 ) / σₚ if no bond, or Sₚ ≔ ( μₚ - μ₀ ) / σₚ if a bond is included |

| Lever | ℰₚ ≔ ∑|wᵢ|, i ≥ 0, a.k.a. risk exposure |

| Tangency Portfolio | If ∃(Cᵗᶢ > 0) and C ← Cᵗᶢ then w₀ = 0, i.e. zero bond position |

| Non-shortselling Solutions | Exist iff ∃C ∀i wᵢ ≥ 0 |

Two Technical Pillars

Algorithm of finding the extrema

≡ σₚ²·C/2 - μₚ + λ (wᵀ1 - 1)

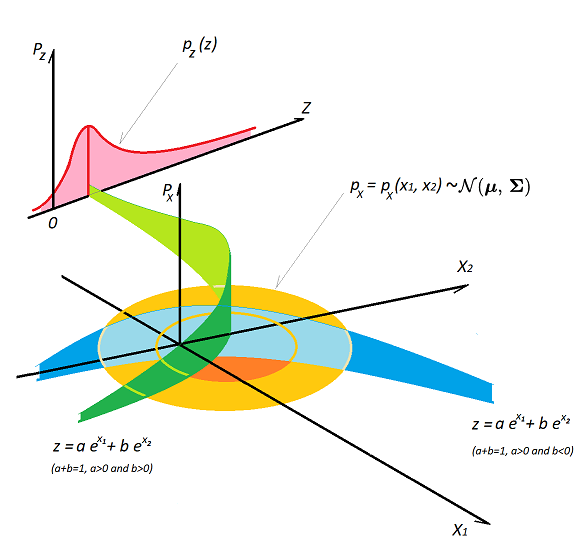

Return Distribution on Maturity